ny mortgage refinance transfer taxes

LendingTree LLC is known as LT Technologies in lieu of true name LendingTree LLC in NY. Use this refinance calculator to figure out what your new mortgage payments will be if you refinance your mortgage.

Reducing Refinancing Expenses The New York Times

Using Inter-Institution Transfers from Citibank is easy.

. And other escrowed items as applicable. An escrow account is the portion of your monthly mortgage payment set aside to pay. Typically mortgage lenders want to see a credit score of 620 or better for a refinance but there are some refinance options if you have poor credit including streamline programs.

With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. No transferring a deed to another person doesnt remove your responsibility to pay the mortgage on the property.

Mortgage rates close in on 6 highest since 2008 The rate on the 30-year fixed mortgage jumped to 589 from 566 the week prior according to Freddie Mac. To mitigate potential financial and legal troubles the grantee can assume the mortgage with the lender with the lenders approval or refinance the property and pay off the original loan. Youre still responsible for paying property taxes while you have a reverse mortgage.

If so you can deduct points in the year of sale or refinance points you didnt previously deduct. The monthly escrow payment amount equals 112 of the total of your taxes homeowners insurance and mortgage insurance if applicable. As the original owner youre still obligated to make the payments to your lender even if youre divorced and dont have interest in the property.

Renting your second home. Form TP-584 Combined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and Certification of Exemption from the Payment of Estimated Personal Income Tax should be filed with the county clerk where the property is being sold and is due no later than the 15 th day after the delivery of the deed. In the year you pay off the loanbecause you sell the house or refinance againyou get to deduct all the points not yet deducted unless you refinance with the same lender.

Best Balance Transfer Credit Cards. Plan for your future today. If the reverse mortgages principal balance is more than 750000 your interest deduction will be limited.

Learn the specific estate planning documents you need to protect yourself and your loved ones. You might refinance or sell the home before you pay off the mortgage. Also keep in mind the IRS limits mortgage interest deductions to interest paid on up to 750000 of mortgage debt.

In general your realtor. If you itemize deductions you can deduct real estate taxes and points you pay over the life of a mortgage to buy a second home. Transferring property in a state that doesnt charge transfer taxes.

LendingTree technology and processes are patented under US. Make a transfer simply by setting up your non-Citi account by providing the account number and the ABA number. Make one-time and recurring transfers.

The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. An ABA numberor routing numberis a 9digit number assigned to the bank by the American Bankers Association ABA and used for routing.

Better Mortgage Lender Review Nextadvisor With Time

Can You Transfer A Mortgage From Person To Person

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Easy Home Loan Balance Transfer Low Interest Rate Balance Transfer Home Loans Loan

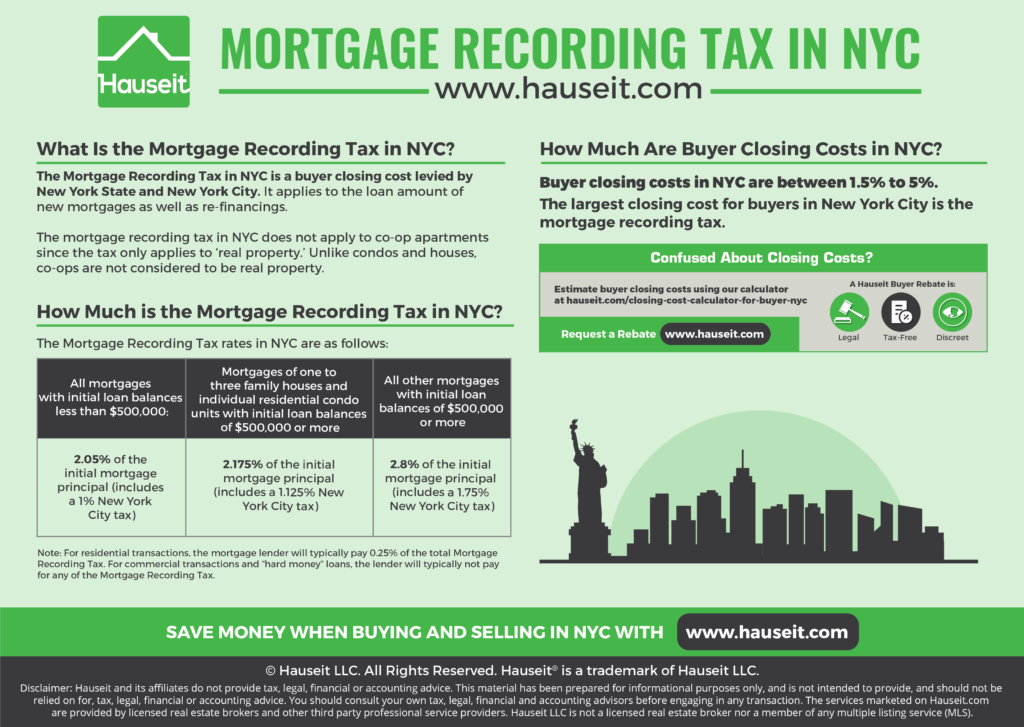

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Can You Transfer A Mortgage To Another Person

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo Yoreevo

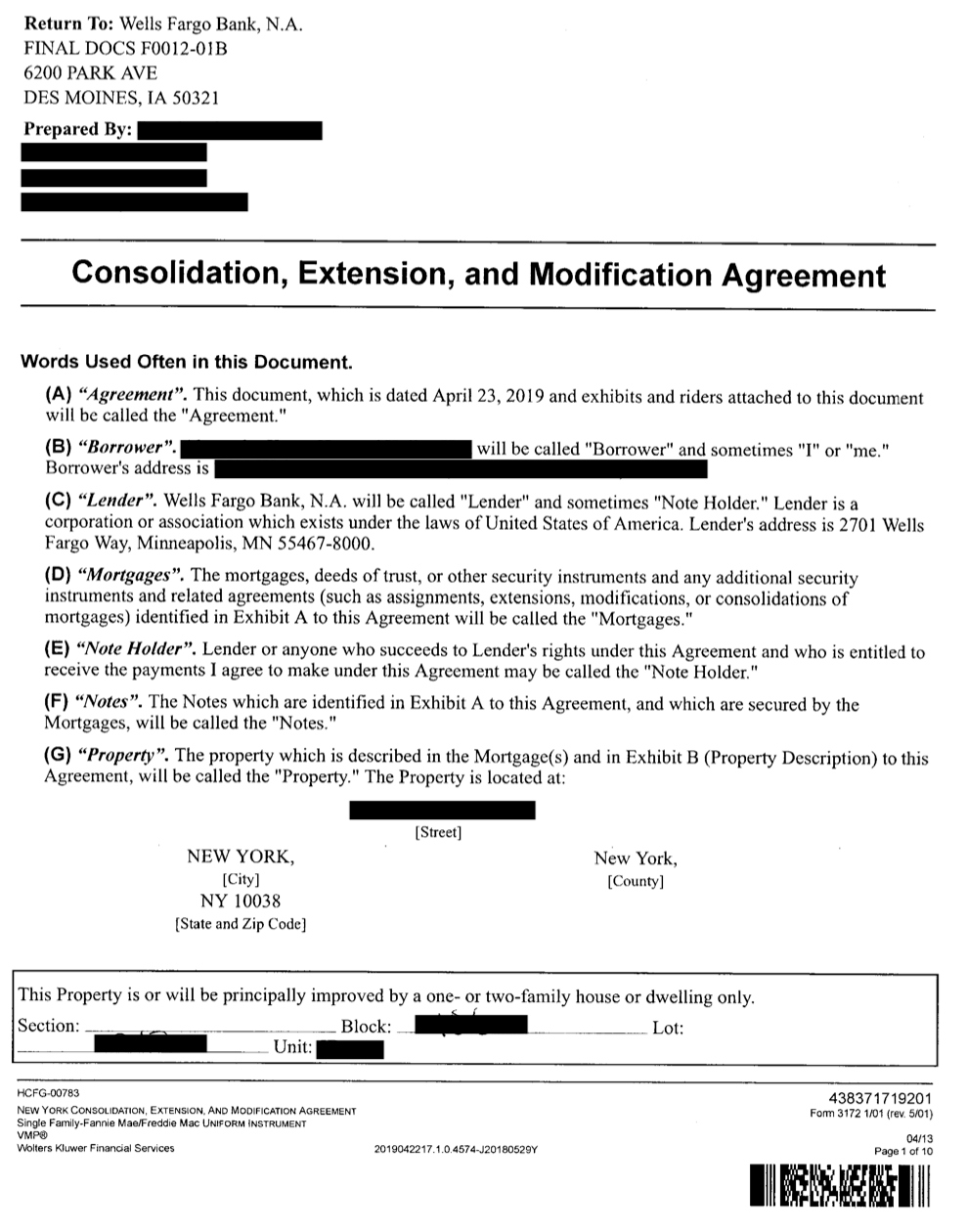

Refinancing Your House How A Cema Mortgage Can Help

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Purchase Cema What You Need To Know Blocks Lots

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo